The original Waldorf-Astoria Hotel, demolished five years after Coolidge’s speech there to make room for the Empire State Building. Photo credit: Shorpy.

The President and Mrs. Coolidge had come to New York in a blinding snowstorm, arriving at the Pennsylvania Railroad terminal late in the afternoon ahead of the speech he was to give at the Waldorf-Astoria that evening. But the weather did not discourage the turnout, as thousands waited to see and, perhaps, greet the President. Babe Ruth had brought his daughter Dorothy who briefly spoke to the Coolidges before the motorcade pulled away en route to the new home of the Women’s National Republican Club on E. 37th Street before heading to the Waldorf. Some 2,000 guests filled the grand ballroom as radio hookup prepared to broadcast the President’s message across the nation. At 7:30pm, the band announced the President’s arrival in the room with “Hail to the Chief.” Coolidge took his place at the speaker’s table while the First Lady sat in the gallery opposite the table. Rounding out the table were some of the most familiar names of New York: Chauncey Depew, Adolph S. Ochs, Simon Guggenheim, James Wadsworth, Theodore Roosevelt, Jr., and August Belmont, Jr. (who financed the original New York subway system) among others.

The misdeeds of some members in Harding’s administration had come to light and the Senate had opened a committee, chaired by Thomas J. Walsh, Democrat of Montana, to investigate matters, beginning its work the previous October. The hearings, as largely expected, had quickly revealed how complex and even tedious the issues involved were. They were not so clearly defined or corruption as widespread as later writers salaciously claim. It was largely a very dry and technical business. Countless witnesses came and went through the committee proceedings that concerned oil leases in Elk Hills, California and Teapot Dome, Wyoming. But in January and February of 1924, drama entered the picture with Doheny’s admission of a $100,000 “loan” involving former Interior Secretary Albert Fall (who had retired to his ranch in New Mexico back in March 1923). Fall himself, called to testify, refused lest he potentially incriminate himself. President Harding’s executive order back in May 1921 transferring jurisdiction of the oil reserves from the Navy to Interior Department was nothing suspicious in itself, merely a matter of administrative routine that had happened countless times in past administrations. Harding had not acted in full knowledge of the opportunity Secretary Fall exploited nor had any of the transactions been discussed, let alone agreed to, in Cabinet conference. What was suspicious was former Secretary Fall’s substantial improvements to his ranch on a salary or income that would not have generated such a sudden windfall.

Oil magnate Harry Sinclair appearing before the Walsh committee hearings, March 1924.

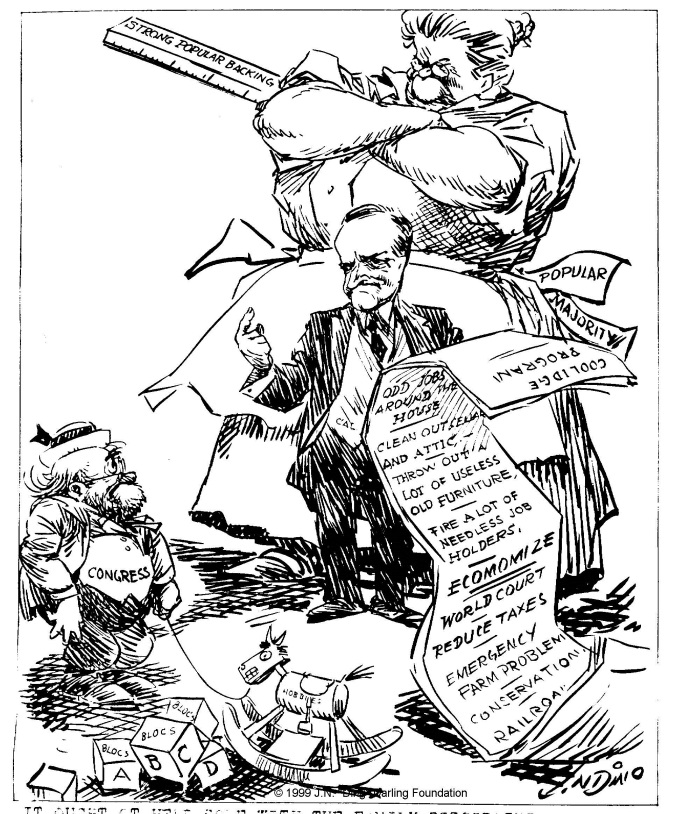

Congressional Democrats gleefully pounced, eager to take political advantage of the situation. Remember, it was now also an election year. President Coolidge had kept close watch as events unfolded. This night he would speak on what was to be done. It had been barely two months since his first State of the Union speech in December 1923, yet so much had taken place that another expansive statement on a host of issues seemed necessary for the benefit of the country. Important political questions on several fronts needed further direction. The pressure to give Congress the satisfaction of multiple heads on platters rose exponentially. His crisp statement the day before, on February 11, in response to the Congressional resolution demanding the resignation of Navy Secretary Denby would powerfully clarify the issue. In that statement he proclaimed:

I shall not hesitate to call for the resignation of any official whose conduct in this matter in any way warrants such action upon my part. The dismissal of an officer of the Government, such as is involved in this case, other than by impeachment, is exclusively an executive function…The President is responsible to the people for his conduct relative to the retention or dismissal of public officials. I assume that responsibility, and the people may be assured that as soon as I can be advised so that I may act with entire justice to all parties concerned and fully protect the public interests, I shall act. I do not propose to sacrifice any innocent man for my own welfare, nor do I propose to retain in office any unfit man for my own welfare. I shall try to maintain the functions of the government unimpaired, to act upon the evidence, and the law as I find it, and to deal thoroughly and summarily with every kind of wrongdoing.

Now, following in 1-2 punch, the supposedly tight-lipped Cal proceeds to fill the air waves in a speech that is still surprising to many now, steeped as we are in the impression that he never said much and when he did, we are told, it was hackneyed, curt, and even callous to the situation. None of that holds as we will see. He reminds his audience to think of the rest of the country when advocating some immediate remedy or seeking the adoption of some new political initiative.

As the population had shifted away from the rural areas to the urban for the first time in American history in 1920, Coolidge saw a danger that political expectations would be increasingly defined by the influence of the cities and be disproportionately driven for the benefit of one at the expense of the other. The populated centers should not selfishly favor their own privileges and particular advantages and forget everyone else. The needs of urban living depended on many other participants whose political rights were no less vital or worthy of preservation. Mere numbers alone did not ensure justice to all. Crisis was not the environment to craft good decisions either. To arrive at the best course for everybody, cool-headed judgment and practical wisdom must prevail. If Lincoln’s legacy taught us anything, Coolidge seems to say, it was to reject the notion that each of us lives unto himself, that each section should be empowered to extract taxes from and political dominance over others, be it one segment of the economy to the rest, the cities over the small towns and countryside, a few veterans over all taxpayers, or the rule from Washington by unaccountable specialists. We may be doing well but what about others, he seems to ask. Never forget, as strong as you may be, those who are the least among us. We are all members of one body, even those which are least esteemed.

Times Square, 1920s

So the country tuned in on the evening of February 12, 1924, to hear what the President would say. What was he going to do? What was ahead for America? Who else might be found in the wrong concerning the oil reserve hearings? It not only marked Lincoln’s birthday but were there signs on the horizon that the nation was heading toward a new kind of sectional fragmentation?

Coolidge took the podium and began:

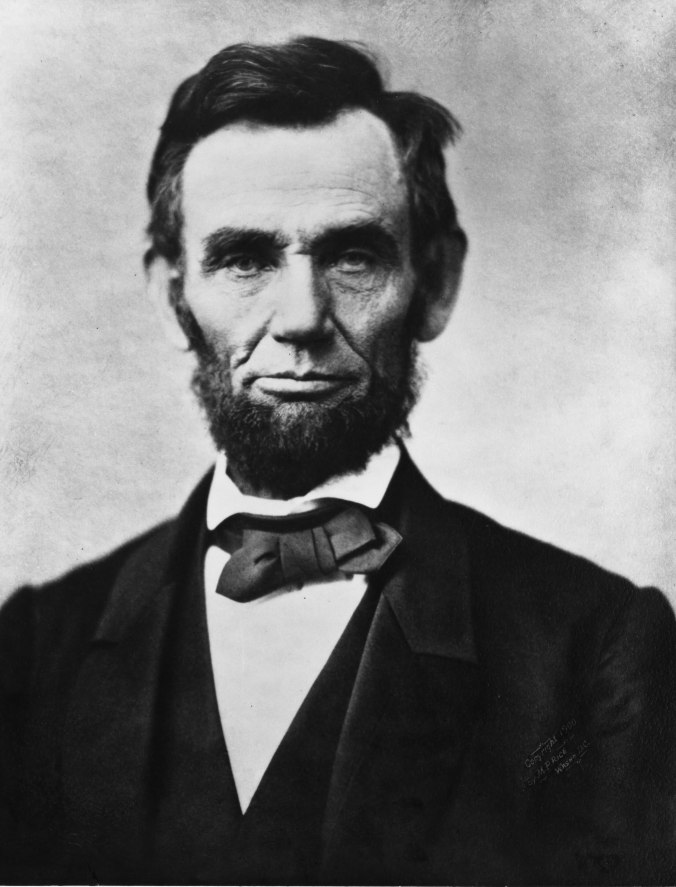

One hundred and fifteen years ago today Abraham Lincoln was born. How great he became cannot yet be accurately measured, although nearly sixty years have passed since his death. Probably there has been no one justly entitled to be determined ‘the greatest man in the world’ as there are many different talents, so there are many different kinds of greatness. This makes comparisons somewhat barren of results. But measured by ability, achievement, and character, America has long placed Washington and Lincoln as the two men in our history preeminently entitled to be determined ‘truly great.’ In this opinion we have the general concurrence of mankind. While others approach them, they are not outranked by any of the other figures which all of civilization has produced throughout its record of thousands of years.

In a way all men are great. It is on that conception that American institutions have been founded. Perhaps the differences are not so much as many suppose. Yet there are differences which set off some men above their fellows. What those differences are in a particular case is a matter somewhat of personal opinion. To me the greatness of Lincoln consisted very largely of a vision by which he saw more clearly than the men of his time the moral relationship of things. His great achievement lay in bringing the different elements of his country into a more truly moral relationship. He was the commander-in-chief of the greatest armies the world had then seen. They were victorious. Yet, we do not look upon him as a conqueror. He directed the raising and expenditure of vast sums of money. Yet we do not think of him as a financier. The course which he followed cost many lives and desolated much territory. Yet we think of him not as a destroyer, but as a restorer. He was a liberator. He struck the fetters not only from the bodies, but from the minds of men. He was a great moral force.

When Lincoln had finished his course, he had made the foundation of freedom stronger and firmer on which to build national unity. Strengthening that principle was the chief accomplishment of his life. He pointed out that the nation could not endure half slave and half free. The mighty work which he did finally left it to endure all free. He restored national unity by restoring moral unity.

The questions which he considered in his day we need have no hesitation in concluding were finally and definitely settled. There is no difference of opinion, no argument about them now. The conclusions which he drew have long been the settled policy of our country. The conflicts of his time have passed away. New developments have taken place, new problems have been met. The industrial struggle which came, lasting up to the days of the World War, for increased compensation to wager earners; for the bettering of their condition, while it has never been fully settled, does not appear at present to be acute. The rewards of labor engaged in commerce, transportation and industry are now such as to afford the most liberal participation in all the essentials of life. What this tremendous opportunity now held by the wage earner, if wisely and justly administered, will mean to the well-being of the nation is almost beyond comprehension. It opens up the prospect of a new era in human existence. It justifies the assertion that while America has problems, it is not lacking in the ability or courage to comprehend and solve them. It is a warrant for confidence in the future.

That national unity for which Lincoln laid the foundation requires perpetual adjustment for its maintenance. How great our country really is, how diversified are its interests, is almost beyond the comprehension of any man. Yet great and diversified as it is, any pretense of sound morals or sound economics requires that each part, each section, and each interest should be looked upon by the government with like solicitude, all sharing the common burdens, all partaking of the common welfare. There is no sound policy which is narrow or sectional, or limited. Every sound policy must be national in its scope. It is always necessary to determine what will be good for the whole country.

The necessary observance of these principles requires, at the present time, that a large amount of attention should be given to agriculture. This is an interest on which it is estimated that more than 40 million of our people are directly or indirectly dependent. It represents an investment several times as large as that of all the railroads of the country. It has an aggregate production of more than $8 billion each year. Yet, with all these vast resources of production and consumption, and the vast purchasing power for the products of the farm, which is represented by the prosperity of our industry and commerce, with here and there an exception, agriculture as a whole languishes.

Production has outrun the power of distribution and consumption. The farm population is not increasing, but the improved methods of tillage and inventions in farm machinery have all contributed to increase the per capita output. It is in this direction that the agricultural schools and colleges have placed their major emphasis. Their education has been substantially all on the side of improved methods of production, and none on the side of distribution, consumption and marketing.

When there is a difficulty which affects so large a population, so large an area, and so important an interest as that of agriculture it is distinctly a national question. It scarcely needs to be pointed out that agriculture is of vital importance to our country. It is the primary source of sustenance, enterprise, industry and wealth. Everyone ought to know that it is basic and fundamental. Without a healthy, productive and prosperous agriculture there can be no real national prosperity. It is perfectly obvious that there is something radically wrong when agriculture is found in its present state of depression at a time when manufacturing, transportation and commerce are on the whole in a remarkable state of prosperity. No one would deny, I suppose, that industrially we are flourishing. Every standard by which prosperity is measured, whether it be production, movement of freight, corporate earnings, employment of labor or bank clearings, all point to the same conclusion.

But agriculture has only partially revived. Its position has been improved and the returns for the year are almost 30 percent in excess of two years ago. The result has been a decrease in the value of farm lands, the choking of the avenues of credit with obligations which are worthless or doubtful, the foreclosure of mortgages and the suspension of a large number of banks. To this depression there have been other contributing causes, but the main difficulty has been the price of farm produce.

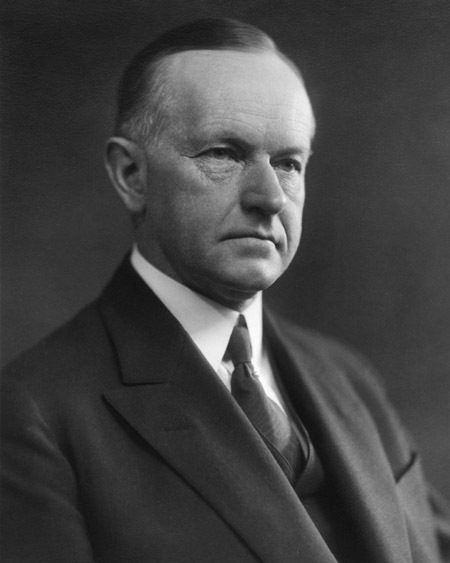

One of several political cartoons from the 1920s. Coolidge, contrary to the current perception, was quite aware and keenly sensitive to the plight of American farmers bereft of Europe’s recovering markets following World War I.

The farm is one of the chief markets for the industries of the nation. You have a direct economic and financial interest. You cannot long prosper with that great population and great area in distress. You have a political interest. The people of those numerous States cast an enormous influence on the making of laws by which you are governed. Unsound economic conditions are not conducive to sound legislation. The farm has a social value which cannot be overestimated.

I shall not now discuss the details of legislation or enter upon a presentation of peculiarly agricultural remedies. I made specific recommendations in my message to the Congress, and there are bills pending for carrying my suggestions into effect. What I am most anxious to impress upon the prosperous part of our country is the utmost necessity that they should be willing to make sacrifices for the assistance of the unsuccessful part.

When an examination is made to ascertain some of the causes of these conditions, among the first which suggest themselves is the amount and method of national taxation. Out of an income of about $60 billion the people of this country pay almost $7.5 billion in taxes, which is over $68 for every inhabitant in the land. Of this amount the national government collects about $3.2 billion and the State and local governments about $4.3 billion. As a direct burden this is a stupendous sum, but when it is realized that in the course of our economic life, it is greatly augmented when it reaches the consumer in the form of the high cost of living, its real significance begins to be appreciated.

The war cost of more than $40 billion is already almost half paid. Amid the disordered currencies of the warring nations, our money is, and had been maintained, at the gold standard. Our budget has long since been balanced, and our debt paying program is at the rate of $500 million each year. In spite of all these expenditures, the next fiscal year has an estimated surplus revenue of over $300 million. Under the watchful care of the Budget Bureau, every department is constantly striving to eliminate all waste and discard every unnecessary expense.

Every reasonable effort has been made to secure the liquidation of our international debts. The largest, which was that of Great Britain, which amounted with accumulated interest to $4.6 billion, has been settled on terms that provide for its payment over a period of sixty-two years, payments in immediate future to be more than $160 million a year. This has laid the foundation for national tax reduction and reform. In time of war, finances, like all else, must yield to national defense and preservation. In time of peace, finances, like all else, should minister to the general welfare. Immediately on my taking office it was determined after a conference with Secretary Mellon that the Treasury Department should study the possibility of tax reductions for the purpose of securing relief to all taxpayers of the country and emancipating business from unreasonable and hampering exactions. The result was the proposed bill, which is now pending before the Congress. It is doubtful if any measure ever received more generous testimony of approval. Opposition has appeared to some of its details, but to the policy of immediate and drastic reduction of taxes, so arranged as to benefit all classes and all kinds of business, there has been the most general approbation. These recommendations have been made by the Treasury as expert adviser of the government. They follow, in their main principle of a decrease in high surtaxes, which is only another name for war taxes, the views of the two preceding Secretaries of the Treasury, both of them Democrats of pronounced ability. They are nonpartisan, well thought out, and sound. They carry out the policy of reducing the taxes of everybody, especially people of moderate income. They give to the country almost $1 million every working day.

The proposed bill maintains the fixed policy of rates graduated in proportion to the ability to pay. It is sustained by sound arguments based on economic, social and moral grounds. But in taxation, like everything else, it is necessary to test a theory by practical results. When the taxation of large incomes is approached with this in view, the problem is to find a rate which will produce the largest returns. Experience does not show that the higher rate produces the larger revenue. Experience is all the other way. When the surtax rate on incomes of $300,000 and over was but 10 percent, the revenue was about the same as it was at 65 percent. There is no escaping the fact that when the taxation of large incomes is excessive, they tend to disappear. In 1916 there were 206 incomes of $1 million or more. Then the high tax rate went into effect. The next year there were only 141 and in 1918, but sixty-seven. In 1919 the number declined to sixty-five. In 1920 it fell to thirty-three and in 1921 it was further reduced to twenty-one.

I agree perfectly with those who wish to relieve the small taxpayer by getting the largest possible contribution from the people with large incomes. But if the rates on large incomes are so high that they disappear the small taxpayer will be left to bear the entire burden. If, on the other hand, the rates are so placed where they will produce the most revenue from large incomes, then the small taxpayer will be relieved. The experience of the Treasury Department and the opinion of the best experts since the rate which will collect most from the people of great wealth, thus giving the largest relief to people of moderate wealth, at not over 25 percent.

A very important social and economic question is also involved in high rates. That is the result taxation has upon national development. Our progress in that direction depends upon two factors–personal liberty and surplus income.

If we had a tax whereby on the first working day the government took 5 percent of your wages, on the second day 10 percent, on the third day 20 percent, on the fourth day 30 percent, on the fifth day 50 percent, and on the sixth day 60 percent, how many of you would continue to work on the last two days of the week? It is the same with capital. Surplus income will go into tax-exempt securities. It will refuse to take the risk incidental to embarking in business. This will raise the rate which established business will have to pay for new capital and result in a marked increase in the cost of living. If new capital will not flow into competing enterprise, the present concerns tend toward monopoly, increasing again the prices which the people must pay. The high prices paid and low prices received on the farm are directly due to our unsound method of taxation.

The packers’ tax goes into the price of the hide to the New England shoe manufacturer. The manufacturers’ tax goes into the price to the wholesaler, and the wholesalers’ tax goes into the price to the retailers, who in turn adds his tax in his price to his purchaser. So it may be said that if the farmer ultimately wears the shoes, he pay everybody’s taxes from the farm to his feet. It is for this reason that high taxes mean a high-price level and a high-price level in its turn means difficulty in meeting world competition. Most of all, the farmer suffers from the effect of this high-price level. In what he buys, he meets domestic costs of high taxation and the high-price level. In what he sells, he meets world competition with a low-price level. It is essential, therefore, for the good of the people as a whole, that we pay not such attention to the tax paid directly by a certain number of the taxpayers, but we must devote our efforts to relieving the tax paid indirectly by the whole people.

Taken altogether, I think it is easy enough to see that I wish to include in the program a reduction in the high surtax rates, not that small incomes may be required to pay more and large incomes be required to pay less, but that more revenue may be secured from large incomes and taxes on small incomes may be reduced; not because I wish to relieve the wealthy, but because I wish to relieve the country.

The practical working out of the proposed schedules is best summarized by the Treasury experts who find that $92 million a year will be saved to those who have incomes under $6,000; $52 million to those who have incomes between $6,000 and $10,000; and that less than 3 percent of the proposed reduction would accrue to those who have incomes of over $100,000. A married man with two children, having an income of $4,000, would have his tax reduced from $28 to $15.75; having $5,000, from $68 to $38.25; having $6,000, from $128 to $72; having $8,000, from $276 to $144; and having $10,000, from $456 to $234.

In order to secure these results the administration bill proposes to reduce the tax on earned income 25 percent and the normal tax on unearned income also 25 percent. This would apply to all incomes alike, great and small, and would provide general and extensive relief. Further reductions would be secured by increasing the amount of income, exempt from surtaxes, from $6,000 to $10,000. Such surtaxes increase progressively until on incomes of $100,000 or more they reach the maximum of 25 percent, which, with the normal taxes of 6 percent, makes large incomes pay in all 31 percent. It is also proposed to repeal many troublesome and annoying rates, such as admission taxes and sales taxes, the existence of which is reflected in the increased cost of doing business and the higher prices required from the people.

Because I wish to give to all the people all the relief which it contains I am opposed to material alteration of and compromise of the tax measure. It is about as far removed as anything could be from any kind of partisanship. At least I do not charge that there is any party or any responsible party leadership that admits it is opposed to making taxes low and in favor of keeping taxes high. But the actions and proposals of some are liable to have just that result. I stand on the simple proposition that the country is entitled to all the relief from the burden of taxation which it is possible to give. The proposed measure gives such relief. Other measures which have been brought forward, do not meet this requirement. They have the appearance of an indirect attempt to defeat a good measure with a bad measure.

You have heard much of the Garner plan. Brought forward to have something different, it purported to relieve the greatest number of taxpayers. it gave not the slightest heed to the indirect effect of high taxes or to the approaching drying up of the source of revenue and consequent failure of the progressive income tax, or to the destruction of business initiative. It is political in theory. When the effect of its provisions was estimated it meant a loss of revenue beyond any expected surplus. It is impossible in practice.

But the people must understand this is their fight. They alone can win it. Unless they make their wishes known to the Congress without regard to party this bill will not pass. I urge them to renewed efforts.

Since August 1919, the public debt has been decreasing. About $4.5 billion has been paid off. This means a reduction in interest of almost $200 million. It is of utmost importance, in order to be able to meet a fast approaching foreign competition, that to keep business good and prevent depression, we reduce our debt and keep our expenditures as low as possible. These are the economic reasons why the granting of a bonus would jeopardize the welfare of the whole country. It was estimated that under the bonus bill which was vetoed, if all the beneficiaries had taken the certificates which it was proposed to issue, the plan would have cost $225 million annually for the first four years, and a total of $5.4 billion. This would more than destroy all the great labor which the country has gone through for the purpose of reducing its debt. It would mean the indefinite postponement of any tax reduction, another increase in the cost of living, more drying up of the sources of credit and a probable raising of the rates of interest; all of which would result in inflation and higher prices, with the grave danger of ultimate disaster to our financial system.

But this question goes deeper than that. I am aware that some men made money out of the war. No doubt there are some such who are justly to be criticized for greed and selfishness. Unfortunately they would not pay the bonus. It would have to be paid by the country. I have already undertaken to demonstrate that taxes are paid by the great mass of people. It is necessary to consider whether there be any moral justification for placing all the people under this great burden, in order to pay some money to a part of the people, many of whom do not want it and are offering pronounced objection to it. A very large body of service men do not want the bonus, and object to being taxed in order that it may be paid. They are just as eager now to save their country from financial disaster as they were formerly to save it from military disaster. They are entitled to be heard. This question ought to be decided in accordance with the welfare of the whole country.

President Coolidge signing the Veterans’ Bureau Hospital bill on the south grounds of the White House, June 5, 1924. The bill appropriated $6.8 million to complete the hospital care program for veterans wounded in combat. Disabled veterans are present for the garden party hosted there that day. Photo credit: Library of Congress.

No one doubts the patriotism of those who advocate the bonus. No one denies that the country owes a debt which it never can pay to those who were in the service. Their disabilities must be recompensed, their health restored, their dependents supported; all at public expense. They are entitled to the highest honor. But the service they rendered was of such a nature that it cannot be recompensed to them by the payment of money.

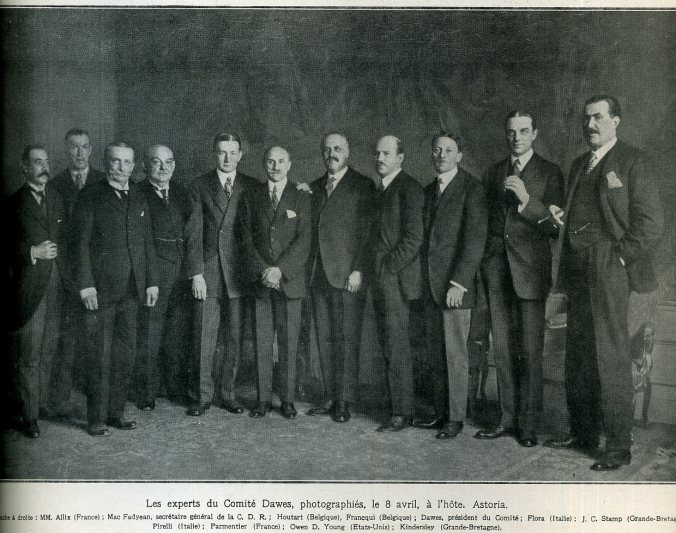

I have lately undertaken to define the outline of the foreign policy of the present government. Nothing has occurred since my message to the Congress that requires any change in that policy. The prospect of a European settlement, however, has arisen, which holds some promise. Three Americans of outstanding and well-seasoned ability have been called to give their expert assistance and advice. They do not represent our government. Their only official standing comes from their being agents of the reparation committee. Yet they cannot help being Americans and will bring to their problem not the point of view of the American government, but, what may be more effective, the point of view of the American mind. Without doubt any settlement would call for a European funding and financing, which would be of doubtful success without American participation.

General Dawes and the committee which resolved the German war debts question. While it did not last forever, it did buy time for Germany and held back for a while the turn to national socialism. Dawes would earn a Nobel Peace Prize for his efforts.

Our government does not want war anywhere. It wants peace everywhere. It does not look with sympathy upon the manufacture or sale of arms and munitions by which one country might make war upon another country. It recognizes, however, that every government must necessarily maintain some military establishment for national defense and the policing of its own domain.

We do not believe in great armaments. Especially are we opposed to anything like competitive armaments. The United States stands ready to join with the other great powers, whenever there appear to be reasonable prospects of agreement, in a further limitation of competitive armaments.

A situation has recently arisen in Mexico which has caused some solicitude. We recognize that the people of that country have a perfect right to set up and pull down governments without any interference from us, so long as there is no interference with the lawful rights of our government or our citizens without their territory. We do not harbor the slightest desire to dictate to them in the smallest degree. When disorder arose there, President Obregon sought the purchase of a small amount of arms and munitions of our government for the purpose of ensuring his own domestic tranquility. We had either to refuse or to comply. To refuse would have appeared to be equivalent to deciding that a friendly government which we had recognized, ought not to be permitted to protect itself. Stated another way, it would mean that we had decided that it ought to be overthrown, and that the very agency which we had held out as able to protect the interests of our citizens within its borders ought not to be permitted to have the means to make such protection effective. My decision ran in a counter direction.

Alvaro Obregon, President of Mexico (1920-1924). Obregon would be succeeded in 1924 by Plutarco Elias Calles. Obregon would win the Presidency again in 1928 but be brutally assassinated, to the astonishment of U.S. administration officials, before taking office.

It was not a situation of our making, but one which came and had to be met. In the meeting of it, I did what I thought was necessary to discharge the moral obligation of one friendly government to another. The supremacy of the Obregon government now appears to be hopeful. Whatever may be the outcome, we are not responsible for it. We did what I believed was right to do under the circumstances. It was not done for the purpose of protecting any particular individuals but to exercise a legal right while at the same time showing our influence in favor of orderly procedure and evidencing our friendship toward the friendly government of Mexico. Any other course would appear to me to be unworthy of our country. I propose to continue whatever course of action is customary between friendly governments.

Lately there have been most startling revelations concerning the leasing of government oil lands. It is my duty to extend to every individual the constitutional right to the presumption of innocence and even more important, of securing the enforcement of the law. In that duty, I do not intend to fail.

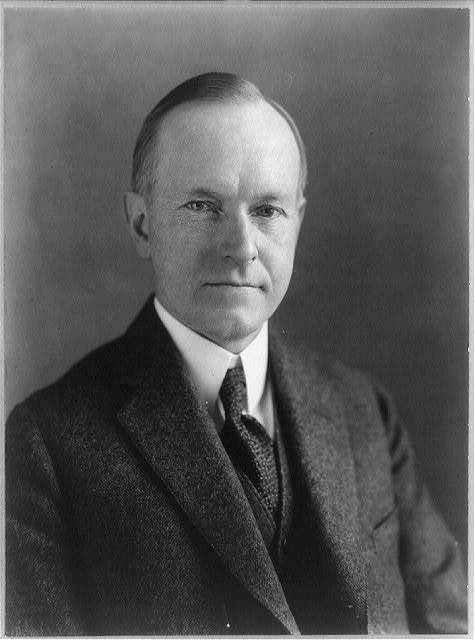

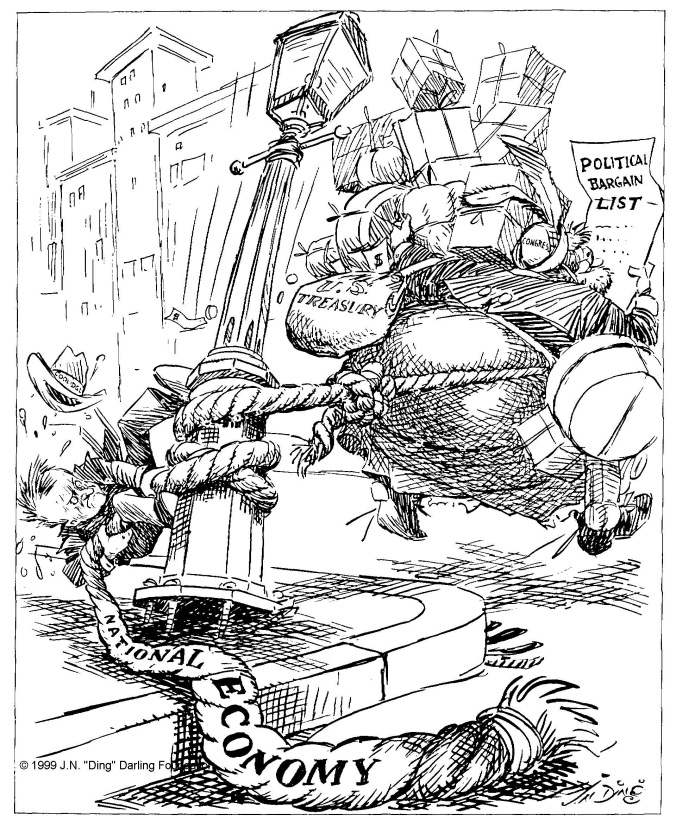

Political cartoon from the Los Angeles Times, February 13, 1924, p.1. It hearkens back to President Coolidge’s strong words on February 11 upon which he builds in this speech.

Character is the only secure foundation of the State. We know well that all plans for improving the machinery of government and all measures for social betterment miserably fail and the hopes of progress wither when corruption touches administration. At the revelation of greed making its subtle approaches to public officers, of the prostitution of high place to private profit, we are filled with scorn and indignation. We have a deep sense of humiliation at such gross betrayal of trust, and we lament the undermining of public confidence in official integrity. But we cannot rest with righteous wrath; still less can we permit ourselves to give way to cynicism. The heart of the American people is sound. Their officers with rare exception are faithful and high-minded. For us, we propose to follow the clear, open path of justice. There will be immediate, adequate, unshrinking prosecution, criminal and civil, to punish the guilty and to protect every national interest. In this effort there will be no politics, no partisanship. It will be speedy, it will be just. I am a Republican, but I cannot on that account, shield anyone because he is a Republican. I am a Republican, but I cannot on that account prosecute because he is a Democrat. I want no hue and cry, no mingling of innocent and guilty in unthinking condemnation, no confusion of mere questions of law with insinuations of fraud and corruption. It is at such a time that equality of our citizenry is tested–unrelenting toward evil, fair-minded and intent upon the requirements of due process, the shield of the innocent, and the safeguard of society itself. I ask the support of our people, as chief magistrate, intend on the enforcement of our laws without fear or favor, no matter who is hurt or what the consequences.

Distressing as this situation has been, it has its reassuring side. The high moral standards of the people were revealed by their instant reaction against wrongdoing. The officers of the government, without respect to party, have demonstrated a common purpose to protect government property and to bring guilt to justice. We have the trials and perplexities of our day but they seem insignificant compared with those which taxed the genius of Lincoln. The government maintained itself then. The government will maintain itself now. The forces of evil do not not triumph. The power of justice cannot long be delayed. The moral force of Lincoln is with us still. ‘He that keepeth Israel shall neither slumber nor sleep.’

As time would reveal, the scandal could not be exploited for partisan purposes despite the best efforts of Congressional opponents and political activists, as the involvement of high-profile Democrats in the oil lease transactions of Doheny soiled them as well. As a result, it foreclosed a number of Presidential candidacies that year. This was no collusion of one party with “Big Oil” but rather the Siren’s song that lured self-seekers in public office on both sides of the aisle. The Walsh Committee, after a few more months of public hearings, realized nothing further could be gained politically from the testimony and quietly concluded business in May 1924. The real work resided with the special investigators, irreproachable men of both parties, appointed by Coolidge in February. A few individuals had decided the risk of abusing their sacred trust was not greater than the rewards of benefiting themselves. They were wrong. But more than that, Coolidge would make sure the penalties meted out did not destroy the innocent with the guilty. He would not yield to the intense pressures on him to lop heads indiscriminately on the basis of rumor and supposition. Nor would he “circle the wagons” and protect the administration from scrutiny. The interests of the country, not the mere interests of party organization, triumphed.

The investigative team headed by special investigators Atlee Pomerene and Owen Roberts begin their work, February 19, 1924. Photo credit: Library of Congress.

When Attorney General Daugherty declined to send documents requested by investigators, Coolidge took up the role of umpire and had him swiftly confronted and summarily dismissed. He would not indulge the claims of widespread corruption nor placate the cries for mass resignation. The guilty would face the consequences and not make others pay for their wrongs. Navy Secretary Denby, like President Harding himself, had been naive but not criminal. He would be allowed to go once cleared. The Cabinet had not been privy to these departmental abuses and the Coolidge administration, upholding a transparent process, proved worthy of confidence. Coolidge kept his head when many in Congress lost theirs. His appointment of the special investigators focused the issue where it needed to remain: on the facts of the case and the questions of law involved. The intricate nature of the whole matter would challenge the best legal minds in our day and it did so then. It took five years of careful due process and methodical investigation to bring the case to completion, ultimately sending the first Cabinet officer in American history to prison. That would not have happened had Coolidge declined to take the firm position for justice and integrity he took here on this day ninety-six years ago.

Lincoln’s birthday presented the reminder that national unity rests on moral unity. If the house is morally divided, not able to reconcile on shared ideals, one side working at cross-purposes against the other, political and economic disunion is not far behind. It does not all happen at once. The momentum of massive ships like our own continues for a time and we are often lulled by the hum in the sails to think that the wind will never fail. Or, we are convinced that since the economic pie seems to keep growing and debt has not toppled us yet after almost a century long spending spree, we can continue to delay the day when hard decisions must be made and postponed obligations come due. We can take comfort that it will not be our problem but fall on someone else long after we are gone. The costs of that national fragmentation are already underway and they do not fall on one part alone but descend on all, bearing down heaviest on the least among us. When one segment seeks to benefit itself at the expense of others, denying rights deemed obsolete or unimportant by “the strong” — often those who possess the numbers, education, and material resources in our capitals and big cities — we commit the same self-seeking blunders of one geographic section seeking to dictate to another in Lincoln’s day. We think the whole body would do better if we got rid of everything that isn’t our particular part, our individual function, and thus come to believe there is virtue in our role alone. We buy the delusion that progress as a single organ is both desirable and possible. Lincoln and his successor Calvin Coolidge reveal the price of this course. Together they warn us what disaster awaits everyone when the good of the whole country is subordinated to the political goals, economic interests, and social preferences of any one segment of it. It carries with it a judgment that is not asleep and we will not outsmart it.