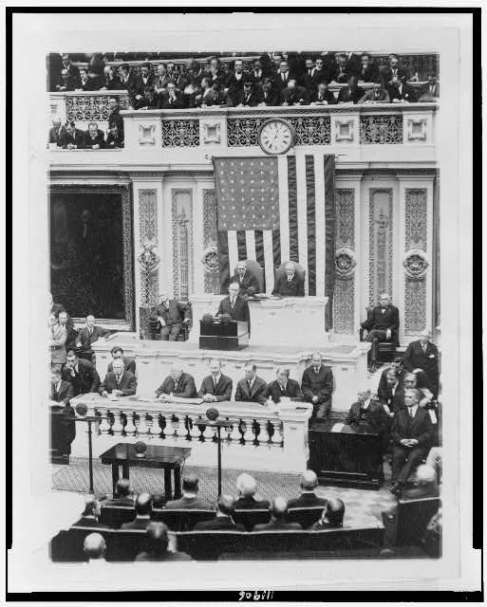

President Coolidge’s first Annual Message to Congress delivered the previous year, December 6, 1923

President Coolidge would open his second Annual Message to Congress by assessing the pervasive destruction of unsound economics, declaring,

The fallacy of the claim that the costs of government are borne by the rich and those who make a direct contribution to the National Treasury can not be too often exposed. No system has been devised, I do not think any system could be devised, under which any person living in this country could escape being affected by the cost of our government. It has a direct effect both upon the rate and the purchasing power of wages. It is felt in the price of those prime necessities of existence, food, clothing, fuel and shelter. It would appear to be elementary that the more the Government expends the more it must require every producer to contribute out of his production to the Public Treasury, and the less he will have for his own benefit. The continuing costs of public administration can be met in only one way — by the work of the people. The higher they become, the more the people must work for the Government. The less they are, the more the people can work for themselves.

To restore the proper ownership of what people earn was what drove Coolidge and Mellon to insist upon Congress cutting rates across the board, fighting to eliminate penalties like the estate tax and genuinely reducing expenditures (remember this was before baseline budgeting). While the Revenue Act of 1924 retained the tax on estates (to Coolidge’s disappointment), it would continue the decrease of rates from 58 to 46% at the top and down to 1.125% at the bottom. For Coolidge, tax and expenditure reduction was a moral obligation. Higher and higher rates bore inescapable costs on everyone. Though the Federal minimum wage would not arrive until 1933 ($0.25/hr), it (like all taxes on what is earned) only harm everyone, employer and employee, rich and poor alike, shackling the future to government spending habits. Higher rates, as they had become in Coolidge’s lifetime, were an avoidable source of division for what should be a United States. As President Coolidge knew all too well, feeding class warfare as the basis for tax policy would only spread suffering and prevent the return of economic health.